Insurance Guide

What is Insurance & How does It Work?

Life is full of risks and unexpected things can happen at any time and they can have a devastating effect on your life, your family, your property or your ability to earn a living. That is why we have insurance, its one way that you can reduce the financial and emotional impact of sudden setbacks.

Insurance is complex and confusing and in some cases you are buying a solution to something that may or may not happen. But what you are buying is "Peace of Mind" and the ability to transfer the risk out of your hands and onto someone else who has analysed that risk and will protect you if something defined goes wrong.

This post is an excerpt from our Insurance Guide that aims to make insurance easier to understand and therefore making it easier to make the right decisions when it comes to protecting what's important.

So what exactly is insurance?

Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company.

The Insurance company does this by charging their clients a premium to create a big pool of money so that anyone who is unfortunate enough to suffer a loss is reimbursed from the pool. This makes payments more affordable for the insured.

The insurer pools clients' risks to make payments more affordable for the insured.

But we must remember insurance is a business and not a service that helps people in times of need. Insurance companies operate to make a profit therefore for insurance to work they need to collect more in premiums than they pay out in claims and administration.

On the flip side, if you have no insurance and an accident happens, you may be responsible for all related costs. Having the right insurance for the risks you may face can make a big difference in your life. So, it’s a question of risk…

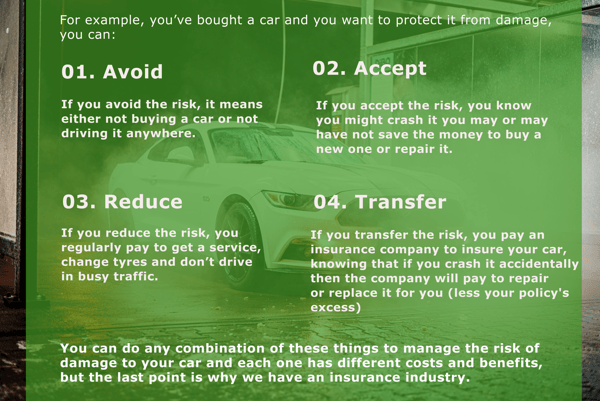

… And as an individual we react to risk in 4 ways:

Therefore insurance companies manage and transfer your risk by providing protection against a predictable event that may arise unexpectedly in return for the payment of a premium.

That said, we all have the option to self-insure and personally find the money needed in the event of loss or they can buy insurance by taking out an Insurance Policy. If you can, try and build your own pool of money to minimise the cost of insurance.

So how does Insurance work?

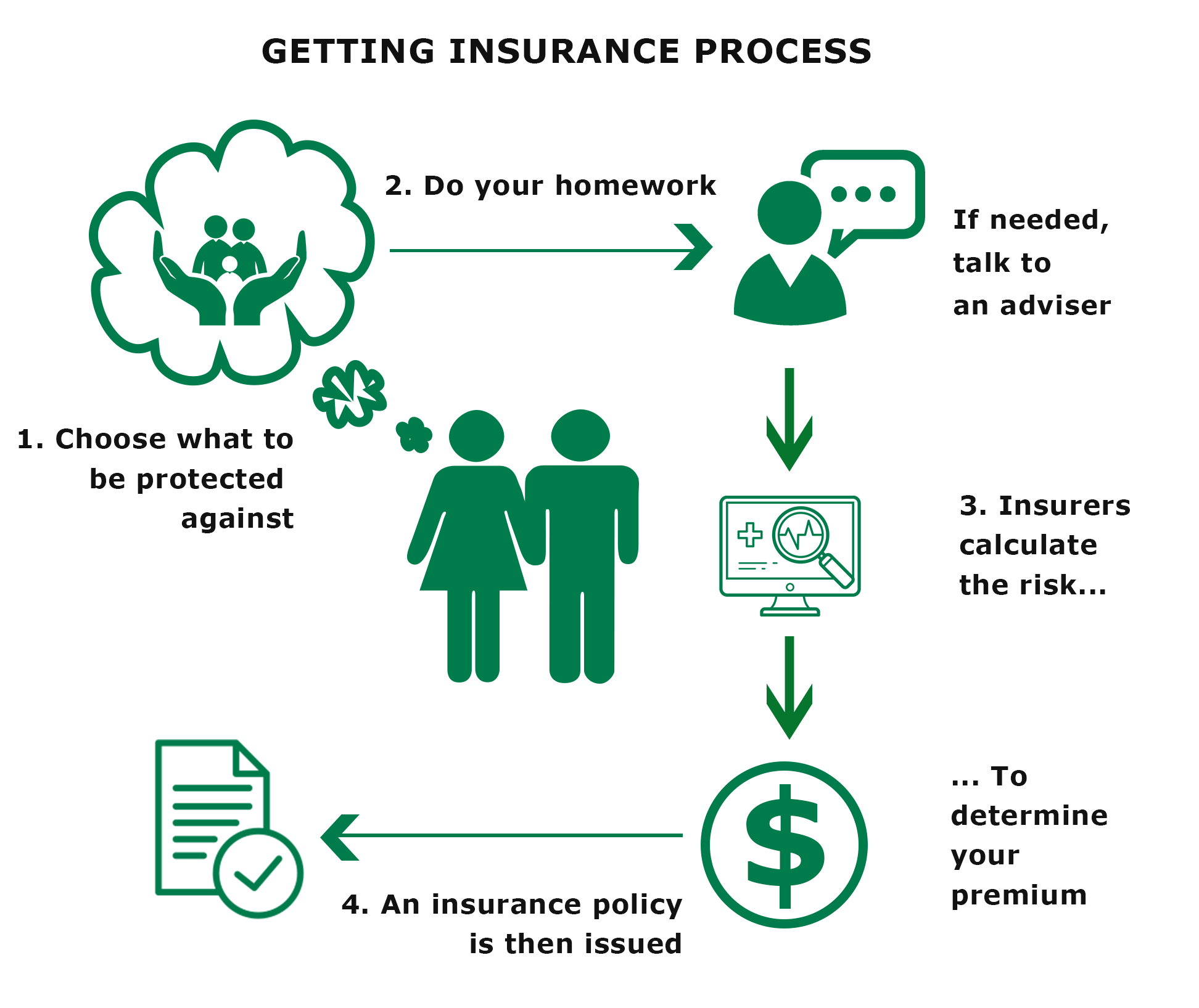

With insurance, you choose what you want to be protected against.

Then, you do your homework as not all insurance policies are the same. Better still talk to an adviser who can help you work through your options before you choose your Insurer.

Then your chosen insurer calculates the risk and probability that the events to be insured will happen and the insurance provider or insurer will determine the price you will need to pay (your premium or subscription).

An insurance policy is then issued and that’s a legal contract between the policyholder (the person or company that gets the policy) and the insurer (the insurance provider), in which the person or company receives financial protection or reimbursement against losses from the insurance company.

Insurance policies are often in place for a specific period of time. This can be referred to as the policy term.

Speak to an expert first...

There are a multitude of different types of insurance policies available, price and terms will be based on each insurers perception of the risk. So to select the best policy for your circumstances or needs get an expert to take you through them.

At HealthCarePlus, we have access to a nationwide team of Monument financial advisers who can provide you with more personalised approach. Monument has been our appointed business partner since the early 1990’s to provide financial advice to our members on life and health insurance products (HealthCarePlus is not legally able to provide financial advice).

It won't cost you anything for this chat and there is no obligation for you to do anything following the conversation. But we do strongly recommend that if you are interested in looking at life insurance further that you seek their advice before making any decisions.

So to speak directly to a Monument financial adviser in your local area, please click the button below to book a chat with them.

Leave a comment