Health Insurance Article

The true costs of surgery

When unexpected medical events happen, the true cost of surgery can take many Kiwi families by surprise. Due to the demands placed on our public health system, waiting for treatment that you won’t need to pay for, can take about 4 months - which can impact your ability to work and earn, your recovery, and your family.

For New Zealanders who elect to pay from their own hard-earned savings to get faster, private surgery, the costs - even in NZ - can be considerable. In this article, we will explore the typical costs of some common surgeries in New Zealand, and how you can pay for these costs.

How much does surgery cost in New Zealand?

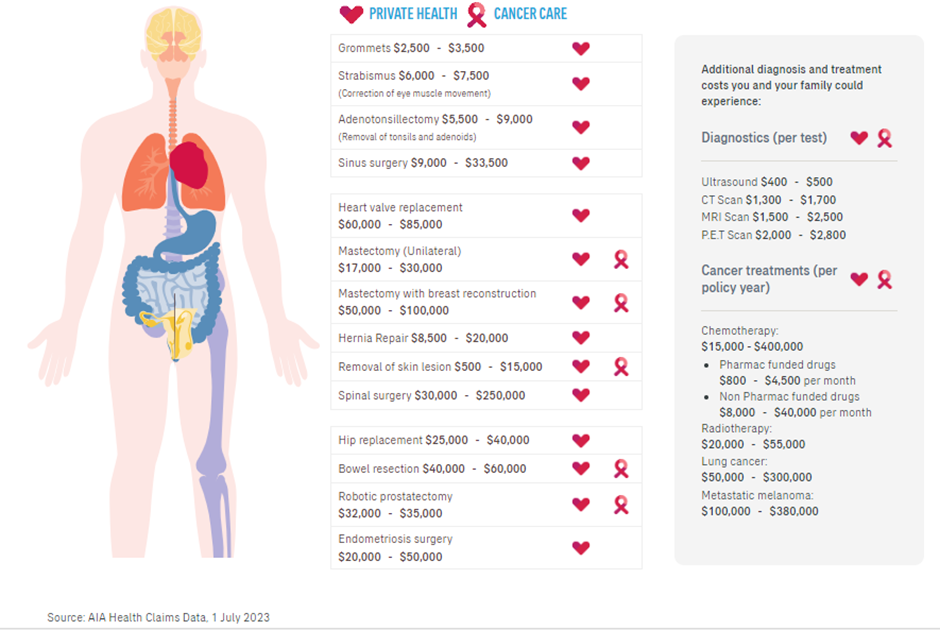

The cost of surgery in New Zealand can vary depending on the type of procedure, the hospital, the surgeon, the anaesthetist, and other factors. However, to give you an idea of the average costs of some common procedures, here are some figures from AIA Health Claims Data, 1 July 2023 (1).

How can you pay for surgery in New Zealand?

There are three main ways to pay for surgery in New Zealand: through the public health system, through private health insurance, or through self-funding.

Public health system

The public health system in New Zealand provides free or subsidised access to essential health services for all eligible residents. This includes some elective surgeries that are deemed to be clinically necessary and have a high priority. However, not all surgeries are funded by the public health system, and even if they are, there may be long waiting lists and limited choices of providers. According to New Zealand Doctor (2), at the end of May 2023, there were 29,841 people who had waited over four months for elective surgery on the national waiting list and 51,202 people who had waited more than 16 weeks for a first specialist assessment.

Private health insurance

Private health insurance is a way to cover some or all of the costs of private healthcare services in New Zealand. Private health insurance can give you more options and faster access to elective surgery without having to wait in the public health system or pay out of your own pocket. Depending on your policy and provider, private health insurance can cover 100% of your major medical expenses (minus the excess you choose), as well as some additional benefits such as specialists and tests or dental cover. Some policies also offer cover for non-Pharmac funded treatments, including certain Medsafe-approved life-extending cancer treatments.

Self-funding

Self-funding means paying for your surgery out of your own savings or income. This can be an option if you do not have private health insurance or if your policy does not cover your procedure. However, self-funding can be very expensive and risky, as you may not be able to afford the full cost of your surgery or any unexpected complications that may arise. You may also have to pay a deposit before your surgery or settle your bill within a certain timeframe after your surgery.

How to choose the best option for you?

The best option for paying for your surgery in New Zealand depends on your personal circumstances and preferences. You may want to consider factors such as:

- The urgency and priority of your surgery

- The availability and quality of public healthcare services in your area

- The cost and coverage of private health insurance policies and providers

- The affordability and sustainability of self-funding

- The potential risks and benefits of each option

So if it is challenging for you to work out the best option for you and your family and you’d prefer to work with a financial adviser, we have access to a nationwide team of Monument financial advisers who can provide you with personalised advice on Health Insurance. Monument has been our appointed business partner since the early 1990’s to provide financial advice to our members on life and health insurance products (HealthCarePlus is not legally able to provide financial advice).

They are the experts and can talk specifically about your individual health needs and can give you an honest view as to whether Health Insurance is right for you. Plus they have access to all the main New Zealand Health Insurance Providers so can explain which of their many health plans are best suited to your needs.

So to speak directly to your local Monument adviser, please click the button below to book a free, no obligation chat with them.

If you are not ready to talk to an adviser and want to find out how much it would cost you for the medical cover, then you can get a quote for Hospital Select. Please note this plan is only available to eligible union members within the education and public services sectors, and is underwritten by UniMed - our health insurance partner.

You can also download our Health Insurance Guide here to learn more about Health Insurance.

Sources:

Leave a comment