Money Matters

How our retirement system stacks up and what it means for you

Each year, two major reports share valuable insights into how Kiwis are faring in retirement…and how ready we are for the decades we’re likely to spend there.

- Mercer CFA Institute Global Pension Index, ranks the pension systems of 52 countries, measuring how generous, sustainable, and trustworthy each one is.

- Massey University Fin-Ed Centre’s Retirement Expenditure Guidelines (REGs), dig into what retirees are actually spending - from food and rates to fun - to help Kiwis plan their financial futures.

Together, they tell an interesting story: New Zealand’s retirement system ranks well globally, but many Kiwis still need to supplement NZ Super to retire comfortably.

For many of us, retirement might feel far away but the decisions you make now can shape the kind of lifestyle you’ll be able to enjoy later.

This month, we’re shining a spotlight on an excellent article from our partners at Lifetime Retirement Income, who specialise in helping New Zealanders turn their savings into steady income in retirement.

You can read the original article here: How our retirement system stacks up and what it means for you.

But here’s a quick look at the key insights

A solid B, but room to improve

Lifetime explains that New Zealand’s retirement system is simple and stable, thanks to NZ Super and KiwiSaver. But global comparisons show that many Kiwis will still need extra savings to maintain their current lifestyle beyond 65.

Why the average Kiwi is still topping up

Massey's study puts real numbers around what retirement costs today, with the gap between NZ Super and actual spending hard to ignore.

Currently, NZ Super pays $538 a week for a single person and $828 for a couple.

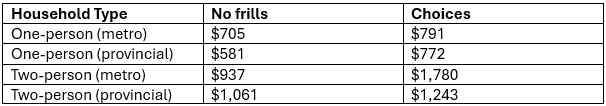

According to the study, though, even the most modest “no frills” lifestyle costs more than this. Below you can see the weekly household expenditures. Noting "no frills" is having coffee at home, and "choices" is going out for coffee at a cafe.

As report author Associate Professor Claire Matthews puts it:

“Most retirees spend more than they receive from Super, and that’s entirely normal.”

The rising cost of staying put

Lifetime highlights something many people don’t consider. Even if your mortgage is paid off, home ownership still comes with ongoing costs, such as rates, insurance, maintenance and heating.

While inflation has eased to around 2.7%, retirees have been hit hardest where it hurts most: food, power, and council rates. In fact, rates have jumped as much as 47% in Wellington in just three years.

That means planning for flexibility is just as important as planning for income.

So, while home ownership is a blessing, it’s also a cost centre. That’s why Lifetime’s home equity release product, Lifetime Home, has resonated with so many Kiwi retirees since launching last year.

“For retirees who are house rich but with little other cashflow, Lifetime Home offers a way to stay in the home you love while unlocking part of its value to support your income,”

“It’s a debt-free home reversion option that lets you tap into your biggest asset - your home - without the stress of repayments or moving out.”

- Ralph Stewart, Lifetime Retirement Income, Founder and Managing Director

Turning savings into secure income

Both reports land on a common truth: the challenge isn’t just saving for retirement, it’s living through it.

This is where Lifetime Retirement Income’s expertise comes in. KiwiSaver helps you build a nest egg, but it doesn’t explain how to turn that into weekly income when the time comes.

Understanding the difference between a lump sum and a reliable income stream is a crucial step for anyone approaching retirement.

As Stewart puts it,

“Managing money over a 20 or 30 year retirement is complex. Our role is to make it easier, by providing solutions that adapt to people’s needs and give them confidence that their income will last as long as they do.”

Most of us have been taught how to save, but far fewer understand how to spend those savings wisely once we stop working. Which is exactly what drove Ralph Stewart to launch Lifetime Retirement Income a decade ago: to help kiwis draw a regular, reliable income from their nest egg.

Things to Think About

1. Get clear on what retirement might actually cost

Most people underestimate how much everyday life costs once they stop working. Think about:

-

Rates, home insurance, utilities and maintenance

-

Health-related costs (which tend to rise with age)

-

Transport and travel

-

Replacing appliances or doing home repairs

-

Social activities and hobbies

Using a planning tool like Sorted’s Retirement Planner can help you understand the lifestyle you want and what it might take to fund it.

2. Sense-check your KiwiSaver fund and contribution level

In your peak earning years, even small contribution increases (or choosing a fund better aligned with your goals) can make a meaningful difference to your retirement comfort.

Ask yourself:

-

Am I in the right fund type for my age?

-

When was the last time I reviewed my fund?

-

Do I understand my fund’s risk level and timeframe?

If you need help seek advice from your kiwisaver provider, a financial adviser or Sorted has lots of good tools and resources for Kiwisaver

3. Plan for ongoing homeownership costs

Even when the mortgage ends, home costs continue:

-

Rates increase regularly

-

Insurance premiums rise with age and rebuild costs

-

Maintenance becomes more frequent as homes age

-

Heating and power costs can go up depending on health needs

It’s worth thinking about what “staying put” really means financially — and whether your home will continue to suit your needs later in life.

4. Think about how you’ll convert savings into income

Many Kiwis focus on building retirement savings but few think about how they will turn a lump sum into steady, predictable income.

Lifetime Retirement Income specialises in explaining how this transition works, including:

-

How long savings may need to last

-

How income can be structured

-

What affects the level of weekly/monthly payments

5. Strengthen your financial resilience before you retire

Retirement feels very different when you reach it with:

-

manageable debt (or none at all)

-

a small emergency fund

-

a clear view of your regular expenses

-

a plan for big one-off costs that might pop up

Even small weekly amounts saved now can create valuable breathing room later.

7. Review or create your will and personal documents

If you have a family or assets, NOW is always the perfect time to get your “life admin” in order:

-

Create or update your will (Public Trust offers discounted, easy online options)

-

Document key information (passwords, accounts, emergency contacts)

-

Talk to family about your wishes

-

Keep important documents somewhere safe and accessible

-

Set up an EPA (Public Trust offers discounted, easy online options)

This reduces stress for you and or the people who matter most.

8. Check what “retirement” actually means for you

Retirement today is not one-size-fits-all. Many people:

-

work part-time

-

ease into retirement gradually

-

volunteer or start lifestyle businesses

-

take career breaks before full retirement

It’s worth thinking about what you want life after you retire to look like and what financial flexibility you might need to support that journey.

9. Top-up your savings

Most New Zealanders find themselves increasing contributions or building extra savings later in life. This is normal and often very smart because it’s when:

-

Your income may be at its highest

-

Children are more independent

-

Mortgages are smaller

-

You have a clearer picture of life after 65

It’s never too late to make a meaningful difference. But the earlier you start the greater the pot at retirement.

A final thought from us

Solid retirement isn’t simply about reaching 65, it’s about having the confidence to live well thereafter. The latest review of New Zealand’s retirement framework shows there are strong foundations in place, but also real areas to be proactive about.

The takeaway? While government provision gives everyone gives everyone a starting point through NZ Superannuation and savings schemes like KiwiSaver. The real difference in retirement comfort comes from the small, deliberate steps taken in the years leading up to it.

Thanks again to Lifetime Retirement Income for these insights and here's the article in full again: How our retirement system stacks up and what it means for you. It's well worth a read.

Original Article Written by: Vanessa Glennie

Vanessa is Head of Communications at Lifetime Retirement Income. She’s an experienced investment writer, having spent more than a decade writing about financial markets in the global fund management industry.

Have you thought about Lifetime Retirement Income to look after your money in retirement?

If you’d like to find out more about any of our retirement income solutions, including Lifetime Income, Lifetime Home and Lifetime Invest, their locally-based income specialists are on hand to chat.

So click on the button below and contact Lifetime Retirement Income to find out more.

Leave a comment