Life Insurance Guide

What is Life Insurance & Do You Need It?

Life is full of risks and unexpected things can happen at any time and they can have a devastating effect on your life, your family, what you own or your ability to earn a living.

That is why we have life insurance, its one way that you can reduce the financial and emotional impact should the worst happen. But the world of life insurance is complex. Customers are buying an intangible product that can often be confusing and complicated with technical terminology, conditions, obligations, jargon and product documents with many pages outlining what you are or are not covered for.

At the same time, life insurance is an important part of your financial resilience and wellbeing - if you understand it, then you're able to make more informed choices about your finances and risk management practices.

So, what is life insurance?

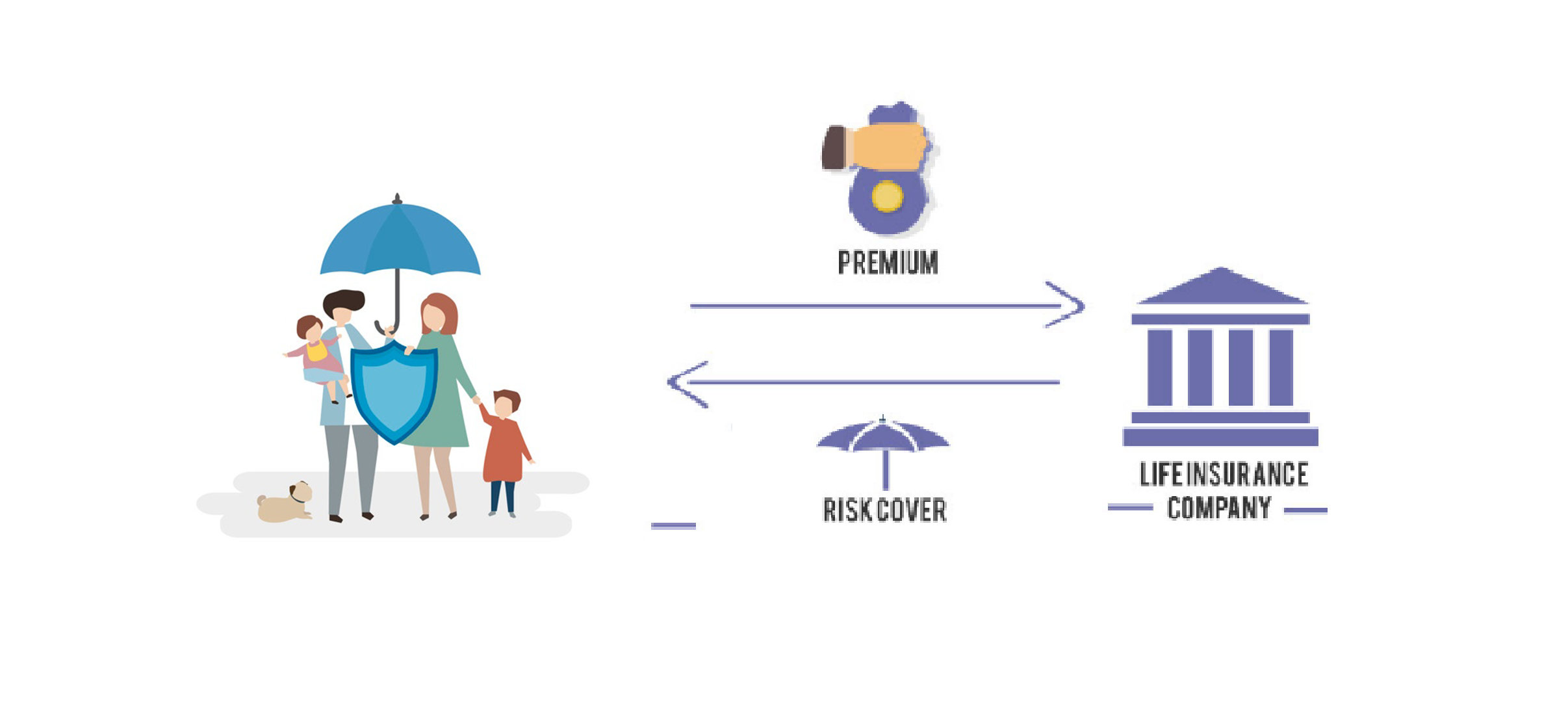

A life insurance policy is a contract between an insurance company and you (the policy owner). It’s an agreement that, in the event of your death, the insurance company will pay the sum insured to your loved ones (or to you, if you are terminally ill and expected to die within 12 months). Your cover is fully tailored and takes into account your age, medical history and personal lifestyle.

This is one of the most important types of insurance that you can have. Life insurance seeks to protect your loved one’s financial security in the case of your premature death and with many policies if you are diagnosed with a terminal illness and expected to live less than 12 months during the term of the contract.

It provides this by paying a tax fee lump sum to your dependants that can be used to reduce debt, pay off mortgage, pay for final expenses, replace your income, or provide an inheritance. The purpose of the funds are entirely yours to decide.

Do you need Life Insurance?

Most people with dependants need some life insurance – just in case the unthinkable happens.

At a minimum, life insurance should cover your debts, funeral expenses, full repayment of your mortgage (including any early-repayment fee), and your family's immediate living costs.

As well, you could add in the amount required to replace any lost income, or pay for a caregiver or alternative schooling arrangement, until the dependant family members are no longer dependent on your support.

Take the time to consider how much money your loved ones might need to maintain their living standards if you were to pass away. This might include costs such as bills, mortgage repayments, school fees and any other debts you might need to repay.

Life Insurance is your way of looking after your loved ones when you’re gone.

What do most people use life Insurance for?

- Paying off the mortgage. Many people need to reduce their debt as quickly as they can if they go from two incomes to one.

- Providing future financial support for their children. For example, someone could use part of their life insurance payment, after becoming terminally ill, to pay for their children’s tertiary education.

- Providing extra income for their family after they’ve gone, or contributing to their spouse’s retirement fund. Many people would need financial support if an income earner passed away.

- Paying for childcare support if the person who passed away was the primary caregiver. Many people find that, as the remaining parent, they need extra support. If they continue working, they may also need more childcare support.

This post is an excerpt from our new Life Insurance guide that aims to make insurance easier to understand and therefore making it easier to make the right decisions when it comes to protecting what's important.

If it is challenging for you to work out the best option for you and your family and you’d prefer to work with a financial adviser, we have access to a nationwide team of Monument financial advisers who can provide you with personalised advice on Life Insurance. Monument has been our appointed business partner since the early 1990’s to provide financial advice to our members on life and health insurance products (HealthCarePlus is not legally able to provide financial advice).

They are the experts and can talk specifically about your individual needs and can give you an honest view as to whether Life Insurance is right for you. Plus they have access to all the main New Zealand Insurance Providers so can explain which of their many plans are best suited to your needs.

So to speak directly to your local Monument adviser, please click the button below to book a free, no obligation chat with them.

Or if you are not ready to talk with an adviser and just want to find out how much it would cost your for life cover, then check out our estimate tool. In less than a minute and just a few simple questions you can get a range of premium costs from most of New Zealand’s major insurance providers across a number of cover options.

Leave a comment